Bill: Streamlining Your Finances & Operations For Modern Businesses

In today's fast-paced business world, managing financial operations efficiently is not just an advantage; it's a necessity for survival and growth. From handling invoices to tracking expenses, the complexities can quickly overwhelm even the most organized entrepreneurs. For anyone, perhaps a "Bill Curtis" seeking robust solutions, understanding how modern platforms can simplify these critical tasks is paramount. This article delves into the functionalities and benefits of a leading financial management platform, often simply referred to as "Bill," exploring how it transforms back-office workflows and addresses common user challenges, all based on recent user feedback and product descriptions as of January 4, 2024.

The digital age has ushered in a new era of financial tools designed to automate, integrate, and optimize the way businesses handle their money. Whether you're a small startup or a growing enterprise, the goal remains the same: to get paid faster, pay efficiently, and maintain crystal-clear visibility over your cash flow. We will explore how this innovative platform serves as a comprehensive solution for accounts payable, accounts receivable, and overall spend management, providing insights into its features, support, and how it helps businesses thrive in a competitive landscape.

Table of Contents

- Understanding the Core Value of Bill for Businesses

- Simplifying Accounts Payable (AP) with Bill

- Mastering Accounts Receivable (AR) and Invoicing

- Comprehensive Spend and Expense Management

- Addressing Common User Concerns and Support

- Navigating Login and Access for Bill Spend & Expense

- The Broader Context: Beyond Financial Software – User Experiences and Technical Hiccups

- Why Businesses Are Joining Bill

Understanding the Core Value of Bill for Businesses

At its heart, the Bill platform is designed to be a central hub for all things financial for businesses of varying sizes. It goes beyond mere bookkeeping, aiming to automate complex tasks and expand opportunities for firms by offering comprehensive spend and expense management services. The platform’s core value lies in its ability to streamline operations that traditionally consume significant time and resources. For a professional like Bill Curtis, who might be overseeing financial departments or managing a burgeoning enterprise, the promise of automating these crucial functions is incredibly appealing. It’s about transforming manual, error-prone processes into efficient, digital workflows. This includes everything from client bill pay to intricate accounts payable and receivable management, positioning Bill as a vital tool for modern financial health.Simplifying Accounts Payable (AP) with Bill

Accounts payable (AP) is often one of the most time-consuming and labor-intensive aspects of financial management. Businesses constantly receive invoices, which need to be verified, approved, and paid on time to maintain good vendor relationships and avoid late fees. The Bill platform offers a robust solution for automating this entire process. It stands out as a premier accounts payable software, enabling businesses to pay their invoices online with remarkable ease and precision. This automation significantly reduces the manual effort involved in data entry, reconciliation, and payment processing, allowing financial teams to focus on more strategic tasks rather than getting bogged down in administrative minutiae. The platform's ability to centralize invoice management and payment execution means that businesses can achieve greater control and visibility over their expenditures, a critical factor for any Bill Curtis looking to optimize operational costs.Digital Invoices and Electronic Payments

A cornerstone of Bill's AP automation is its emphasis on digital invoices and electronic payments. Whether a business is focused on paying its vendors or getting paid by its clients, Bill simplifies the entire process. The transition from paper-based invoices and checks to digital formats and electronic transactions is not just about convenience; it's about enhancing security, speed, and accuracy. Digital invoices can be received, reviewed, and approved within the platform, eliminating the need for physical paperwork. Electronic payments ensure that funds are transferred quickly and securely, reducing the risk of fraud and delays. This streamlined approach means that small businesses, in particular, can manage their financial transactions with the sophistication typically associated with larger corporations, ensuring every Bill Curtis can manage their accounts with confidence.Mastering Accounts Receivable (AR) and Invoicing

While paying bills is essential, getting paid is the lifeblood of any business. The Bill platform excels in simplifying accounts receivable and invoicing, making it easier for businesses to create, send, and manage invoices. The ultimate goal is to get paid faster, and Bill provides the tools to achieve this. From customizable invoice templates to automated reminders, the platform helps businesses maintain a professional image while ensuring timely collections. The ability to track invoice status in real-time allows businesses to follow up effectively, reducing outstanding receivables and improving cash flow. For any business owner or financial manager, including a meticulous Bill Curtis, optimizing the AR process is crucial for financial stability and growth, and Bill delivers the functionality to make this a reality.Comprehensive Spend and Expense Management

Beyond the core functions of AP and AR, Bill offers a holistic approach to spend and expense management. It integrates tools that automate payments, manage expenses, and enhance cash flow, all within a single, unified platform. This comprehensive suite of services allows businesses to gain a complete picture of their financial health, from incoming revenue to outgoing expenses. By centralizing these operations, Bill helps identify spending patterns, enforce budgets, and prevent unauthorized expenditures. This level of financial control is invaluable for strategic planning and decision-making, empowering businesses to allocate resources more effectively and achieve their financial objectives. A forward-thinking Bill Curtis would find this integrated approach indispensable for maintaining fiscal discipline and fostering sustainable growth.Mobile Accessibility for On-the-Go Management

In today's mobile-first world, accessibility is key. Recognizing this, the Bill app extends its powerful features to mobile devices, allowing users to manage their back-office workflow 24/7, from anywhere. Available for both iOS and Android platforms, the mobile app ensures that financial operations are never out of reach. Whether it's approving an invoice while traveling, checking a payment status from home, or managing expenses on the go, the Bill app provides the flexibility and convenience that modern businesses demand. This mobile capability is particularly beneficial for busy professionals, including someone like Bill Curtis, who needs to stay connected to their financial data without being tied to a desk. It ensures that critical tasks can be handled promptly, maintaining the flow of business operations seamlessly.Addressing Common User Concerns and Support

While the Bill platform offers significant advantages, like any comprehensive service, it also has aspects that users sometimes raise concerns about. According to feedback, some users have reported issues such as being billed early for subscription renewals or, in some unfortunate instances, being billed multiple times for the same subscription. Additionally, some descriptions for charges have been noted as "useless" or "unintelligible," leading to confusion. These are valid points that highlight the importance of clear communication and accurate billing practices from any service provider. Recognizing the need for robust support, Bill offers live assistance to address these and other queries. Their customer support is available from 5 AM to 6 PM PT, Monday through Friday, and from 6 AM to 3 PM PT on Saturdays and Sundays, excluding holidays. This extensive availability demonstrates a commitment to helping users navigate the platform and resolve any issues they encounter. For a user like Bill Curtis who might face a billing discrepancy or require assistance with a specific feature, knowing that reliable support is readily available provides a crucial layer of trustworthiness and reliability. It underscores the platform's dedication to ensuring a positive user experience, even when challenges arise.Navigating Login and Access for Bill Spend & Expense

Accessing the Bill Spend & Expense platform is designed to be straightforward, whether through a web browser or the dedicated mobile app. Users need to understand the proper procedures for logging in to ensure seamless access to their financial management tools. The process typically involves secure authentication steps to protect sensitive financial data. If a spend & expense account is linked to other Bill services, the login process might be integrated, offering a unified access point. However, like with any digital platform, users can occasionally encounter access issues. These might stem from forgotten passwords, account lockouts, or technical glitches. The platform provides clear guidance and troubleshooting steps for such scenarios, ensuring that users can regain access quickly. For anyone, including a detail-oriented Bill Curtis, understanding the login protocols and knowing where to find assistance for access problems is fundamental to leveraging the platform's full capabilities without interruption. The focus on secure and accessible login procedures reinforces the platform's commitment to user convenience and data protection.The Broader Context: Beyond Financial Software – User Experiences and Technical Hiccups

While the primary focus of this article is the Bill financial management platform, it's important to acknowledge that users often navigate a complex digital landscape where various technical issues can arise, sometimes unrelated to specific financial software. The "Data Kalimat" provided for this article includes snippets of user experiences with general computing problems, illustrating the diverse challenges individuals face in their daily digital interactions. These unrelated issues, while not directly tied to the Bill app, highlight the broader need for reliable technology and support in all aspects of life, including financial management.Troubleshooting System Issues: A User's Perspective

Consider the feedback from a user named Bill Foley, who welcomed to the Microsoft community, experienced an issue with a driver, "Pcdsrvc_x64.pkms," that "cannot be loaded." Another user, also named Bill, reported difficulty getting an HP laptop with Windows 7 Ultimate to go into system restore using F11 repeatedly. These scenarios underscore the common frustrations users encounter with operating systems, hardware, and drivers. Such technical hiccups can be incredibly disruptive, preventing users from accessing their systems or performing essential tasks. While the Bill financial app aims to simplify financial workflows, it operates within an ecosystem where users might simultaneously be grappling with these underlying system complexities. This context reminds us that even the most intuitive financial tools need a stable computing environment to perform optimally. For a diligent Bill Curtis, navigating these varied technical landscapes is often part of the daily routine.Software Licensing and Account Management Challenges

Further illustrating the broader digital challenges, the data mentions users struggling with software licensing and account management. One user reported having a product key but not the disk, while another tried Windows 8.1 Pro only to face a product key mismatch. These are classic dilemmas in software activation and ownership, often leading to significant frustration and time loss. Similarly, issues like needing to "disable offline mode in Outlook" or understanding an option called "work offline" that disconnects from the server, point to the intricacies of email client management. The plea for help with "lots of important personal emails" after trying "several things indicated in the website but no success" highlights the critical nature of reliable software functionality and clear troubleshooting guides. These examples, though separate from the Bill financial platform, paint a picture of the digital hurdles users, including individuals like Bill Curtis, frequently encounter. They emphasize the value of platforms like Bill that strive for simplicity and dedicated support in their specific domain, thereby reducing at least one area of digital complexity for their users.Why Businesses Are Joining Bill

The decision for businesses to join a platform like Bill stems from a clear need for efficiency, control, and modernization in financial operations. The platform offers plans and pricing designed to suit businesses and accounting firms of all sizes, making its advanced tools accessible to a broad market. With capabilities to automate AP, AR, spend, and expense management, Bill provides a comprehensive solution that addresses the core financial challenges faced by modern enterprises. It’s not just about digitizing existing processes; it’s about transforming them to enhance cash flow, reduce errors, and free up valuable time for strategic growth initiatives. Businesses are choosing Bill because it simplifies the entire financial process, from creating and sending invoices to managing payments and expenses, all within a single, intuitive platform. For any business leader or financial professional, including a forward-thinking Bill Curtis, the benefits of such integration and automation are undeniable, leading to more robust financial health and operational agility.Conclusion

The Bill platform stands as a testament to how technology can revolutionize financial management for businesses of all sizes. By automating critical functions like accounts payable, accounts receivable, and comprehensive spend management, it empowers organizations to operate with greater efficiency, accuracy, and control. From simplifying digital invoices and electronic payments to offering robust mobile accessibility and dedicated customer support, Bill addresses the multifaceted needs of modern enterprises. While the digital landscape can present various technical challenges, as evidenced by user experiences with drivers, system restores, and software licensing, Bill focuses on providing a streamlined solution for financial operations, aiming to alleviate at least one significant area of complexity. For businesses and financial professionals, including those like Bill Curtis, seeking to optimize their financial workflows, enhance cash flow, and gain deeper insights into their spending, joining Bill offers a compelling proposition. We encourage you to explore how Bill can transform your financial operations, simplifying complex tasks and freeing up resources for what truly matters: growing your business. Have you used a similar platform, or are you considering one? Share your thoughts and experiences in the comments below, or explore our other articles on financial technology to further your understanding.

Bill Gates Fast Facts - CNN

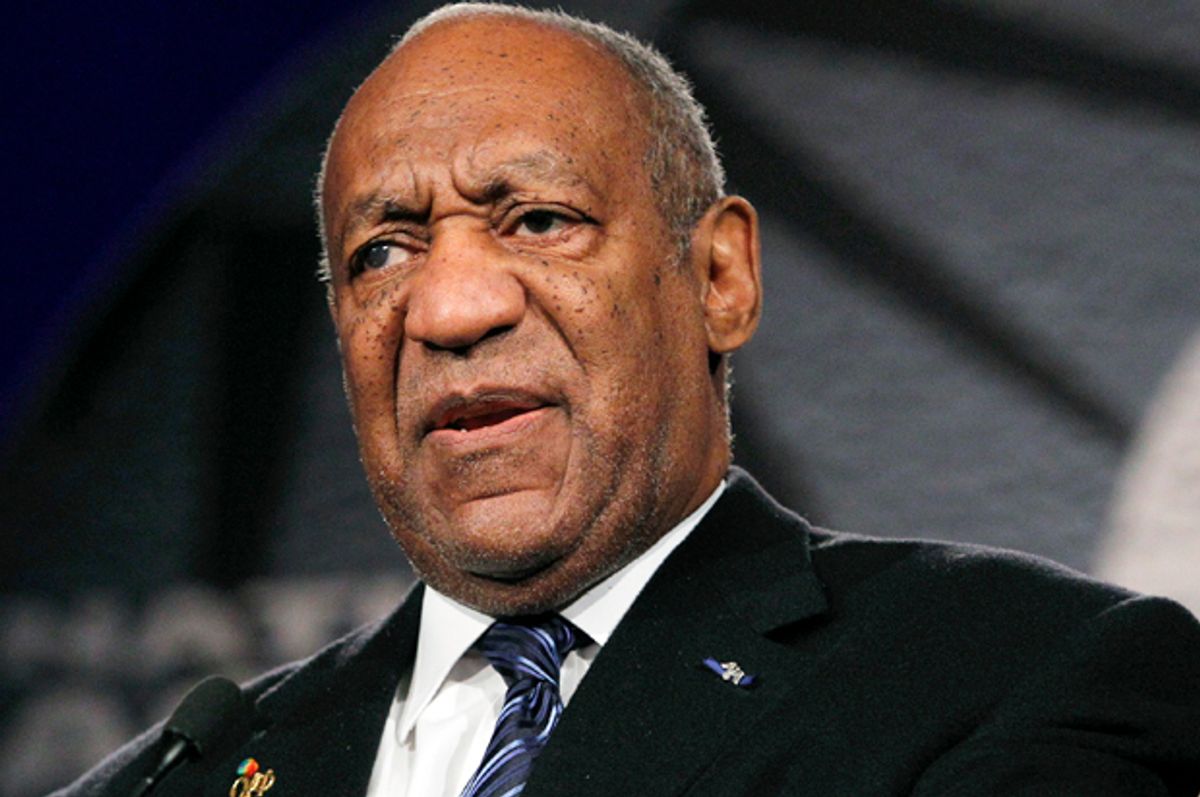

Bill Cosby's media inferno: On journalists reporting justice -- and

Bill Cosby's PR team now says tour isn't about sexual assault | Salon.com